Swami has kudos for the Systematic Investment Plans. I wonder whether the state could design such plans to bring out the moribund gold in India. Just like the ‘Voluntary Declaration of Income’ scheme of the past. At one time ‘ancestral gold’ was a backdoor entry point for black money which too exists but cannot be invested with dignity. Looking at the close nexus between ‘yellow’ gold and ‘black’ money, such schemes could revive (instead of killing?) two birds in one shot!

I was appalled beyond words when the horror story of Shraddha Walkar murder was making headlines. The gruesome details as revealed in the confession of Aftab (her Lover!) and hyped by the media threw me into a bottomless pit of hopeless despair and words failed me as I pondered what future morass the youth of our society was diving into. I kept postponing my comment on the tragedy (Shakespearean minus grandeur) and what it portends.

But life is neither all tragedy; nor all comedy. While I was drowning in my abject despair I stumbled into the weekly piece of ‘Swaminomics’ in ToI of Sunday, Dec 18. Well informed, smart and always very good rea, Swami-his name is too cumbersome to pen-why doesn’t he shorten it into something (street) smart- had overdone himself this time right in the title which read ‘How India went from ‘fragile five’ to Sensex-ational’ and I felt this was the ‘comic relief’ all Shakespearean tragedies tragedy could not do without’. In a way I owe the title of this piece to him. Since I am dwarfed in smartness by Swami, I have broken his tongue twister into the three words it has amalgamated.

If Shraddha created one sensation, Swami created another! If she is at the bottom of human bestiality, Swami is (as always) at the top! He has argued confidently that India has done unexpectedly well in stock market performance in 2022. While the stock markets in the US, Europe, and Asia (China and Japan) crashed drastically Sensex in India was up by 7.5 per cent in mid-December. Starting with this bang his column ends with another:’ a major investment (not named) bank forecasts that India will become a locomotive of the world economy.’

Mind You, I am damn scared of the Bull as its pose suggests. I only superficially understand the booms and the crashes. I cannot empathise with the winners and losers. Moreover, I am puzzled whenever I recall the sign language of eye contact and fingers and wonder how those guys remembered who invested into/withdrew from what at the end of the day. Now these things happen perhaps on-line. I watched ‘Wall Street’ and its sequel to see Michael Douglas and not to educate myself on the pummeling of the Bull! I also fail to grasp how this dashing (Raging) Bull comes a cropper on certain days.

Once I prodded a friend with knowledge of the Bull’s doings. What exactly do the ups and downs of the stock market point to as far as the entire (political) economy is concerned, I asked. Would you conclude that the health of the whole city is excellent if one fitness enthusiast does a thousand push-ups non-stop on a day, he asked in return. I got the message loud and clear. The Bull has been, since then, the tip of the tip of the iceberg of economy for me.

Remember the ill-famous Harshad Mehta? May his soul rest in peace: if he had one! When that ghotala hit the headlines, I happened to meet a senior broker. I tried to sympathise with him because I felt everybody who had anything to do with that scam must be a loser. But not this fellow. He was absolutely happy and said, I almost got three times what I had put in.

Because my timing was perfect: I was not greedy. I knew the bubble was bound to burst. I withdrew just before that! I wondered then and I wonder even now whether to admire his astute timing/cunning…

With such superficial knowledge of the stock market, I don’t want to challenge Swami. Prima facie, he has argued his case very well. India is an emerging market and emerging markets are more vulnerable, he has pointed out. All the more reason to complement our robust stock market and the players, according to him. This to come after the severe production losses during Covid-19 lock downs is still more creditable, as he opines.

India was one of the “fragile five” a decade ago: Brazil, Indonesia, Turkey, and South Africa being the other four. In 2022, while the other four are still dragging their feet, the Indian stock market has shown remarkable resilience. In spite of foreign investors’ cautious restraint, Indian investors’ initiative had brought about this turn around, Swami concludes. He finishes with the quip: quite a change from being the world’s biggest beggar.

This is certainly good news.

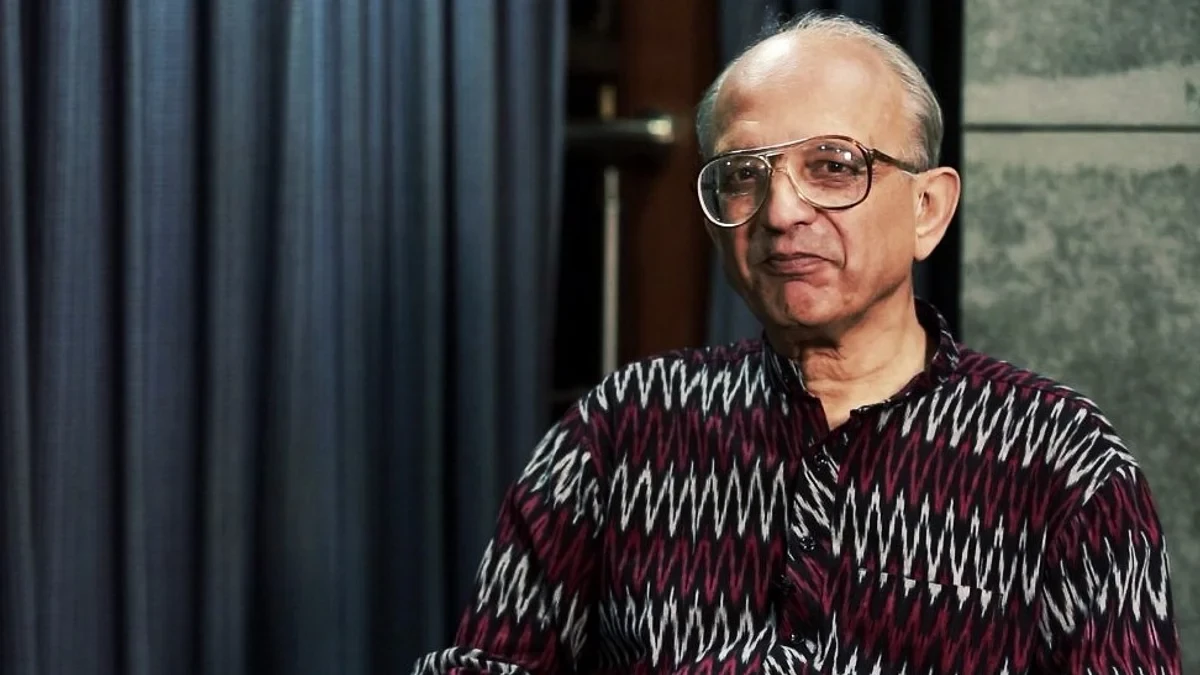

Swaminathan Anklesaria Aiyar

For ages economists have observed that India is a unique society with a very high rate of saving and very low rate of investment. Indians spend their high savings mainly in real estate and accumulation of gold: needless to point out that despite their value both are immobile! First generation Indian capitalists, who were mainly traders, though they travelled far and wide built up their assets in their own towns and in gold. Unlike the proverbial sailor who has a home in every port, the Indian trader had only one (official) home in his backyard and his gold to lay safely there-underground at times. Some years back I divided the roughly estimated immobile tonnes of gold by the then population. The per capita gold in our country worked out to be more than the per capita income. But those who possessed this gold were, just like the speculators in the stock market, the tip of the tip of the iceberg. While I have no way of finding out if that dead gold has come to life in this resilience, it is most reassuring that Indians are coming out of the ‘money saved is money earned’ mindset and learning to participate in the modern economy with the wise investment mantra. Without doubt this is not risk-free but gold too is not.

Swami has kudos for the Systematic Investment Plans. I wonder whether the state could design such plans to bring out the moribund gold in India. Just like the ‘Voluntary Declaration of Income’ scheme of the past. At one time ‘ancestral gold’ was a backdoor entry point for black money which too exists but cannot be invested with dignity. Looking at the close nexus between ‘yellow’ gold and ‘black’ money, such schemes could revive (instead of killing?) two birds in one shot! Yellow and black together will perhaps create ‘brown’- the colour of Indian soil! Any ideas, Swami, and other stock market enthusiasts?

I cherish the achievement of our stock market and do not want to remind Swami that as rosy as it may, India is home to hundreds of millions of poor. India is running forward in economic policy making and backward in nation building.

Tolerance, which was always in short supply, is rapidly declining. India ranks 132nd on Human Development Index among 191 nations and it would be futile to talk of Physical Quality of Index, looking at the about to burst/collapse metros and the vast dry, parched, faceless villages surrounding them-wanting desperately, like Eve, the forbidden Apple of urbanization.

Swami too has checked his euphoria towards the end of the column and concedes- fast growth from a low base is relatively easy: like the weight gain/loss remedies which show miraculous change at the start and gradually attain snail’s pace for every gram gained/lost? We have seen this in the Indian economy not losing to the extent of western economies because as things stood then our economy was not performing as high as those. So let us see how this plays out itself; how long the local investment will continue to flow in; how the risk factor will be neutralized and the stock market Sharks contained.

Dismiss it as a vain hope but let me put it down; in population, India is almost one fifth of the world. With so much gold lying idle and so much trained (such as they are) hands why can’t India be one fifth of the world economy?

- Vinay Hardikar

vinay.freedom@gmail.com

(The writer has been working in the public sphere of Maharashtra for the last five decades. His versatile personality has several dimensions, but the primary ones remain to be that of an established writer, journalist, editor, critic, activist, and teacher.)

Tags: stockmarketeducation marketnews share trader invest financialfreedom nseindia sharebazar technicalanalysis mutualfunds stockmarkets forex warrenbuffet cryptocurrency entrepreneur zerodha shares ipo startupindia daytrader investingtips wealth equity bitcoin bseindia market businessnews mumbai investors daytrading Load More Tags

Add Comment